20+ What Should A Personal Financial Statement Include

To develop strategies for. To meet a co-op boards financial requirements.

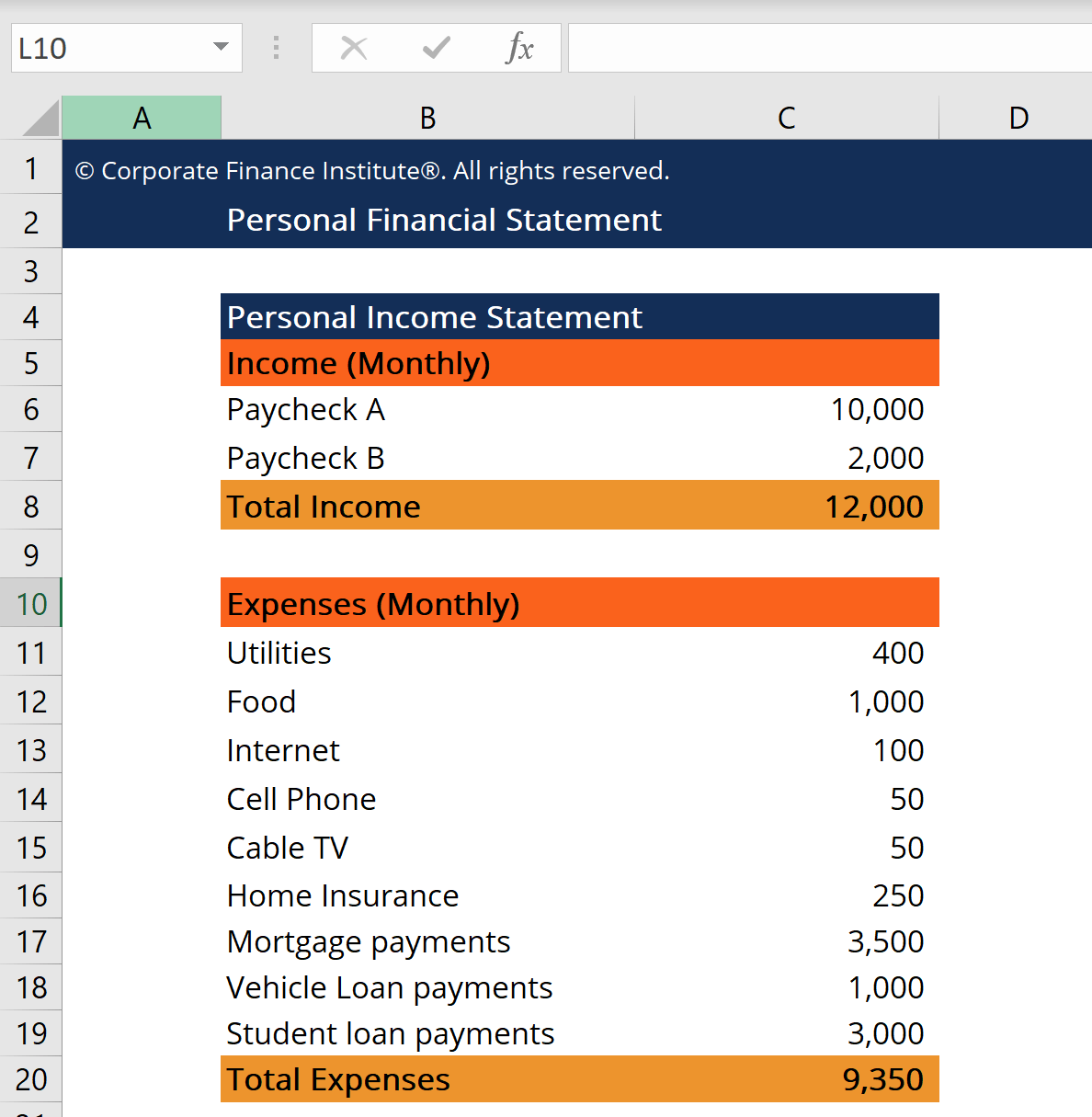

Personal Financial Statement For Excel

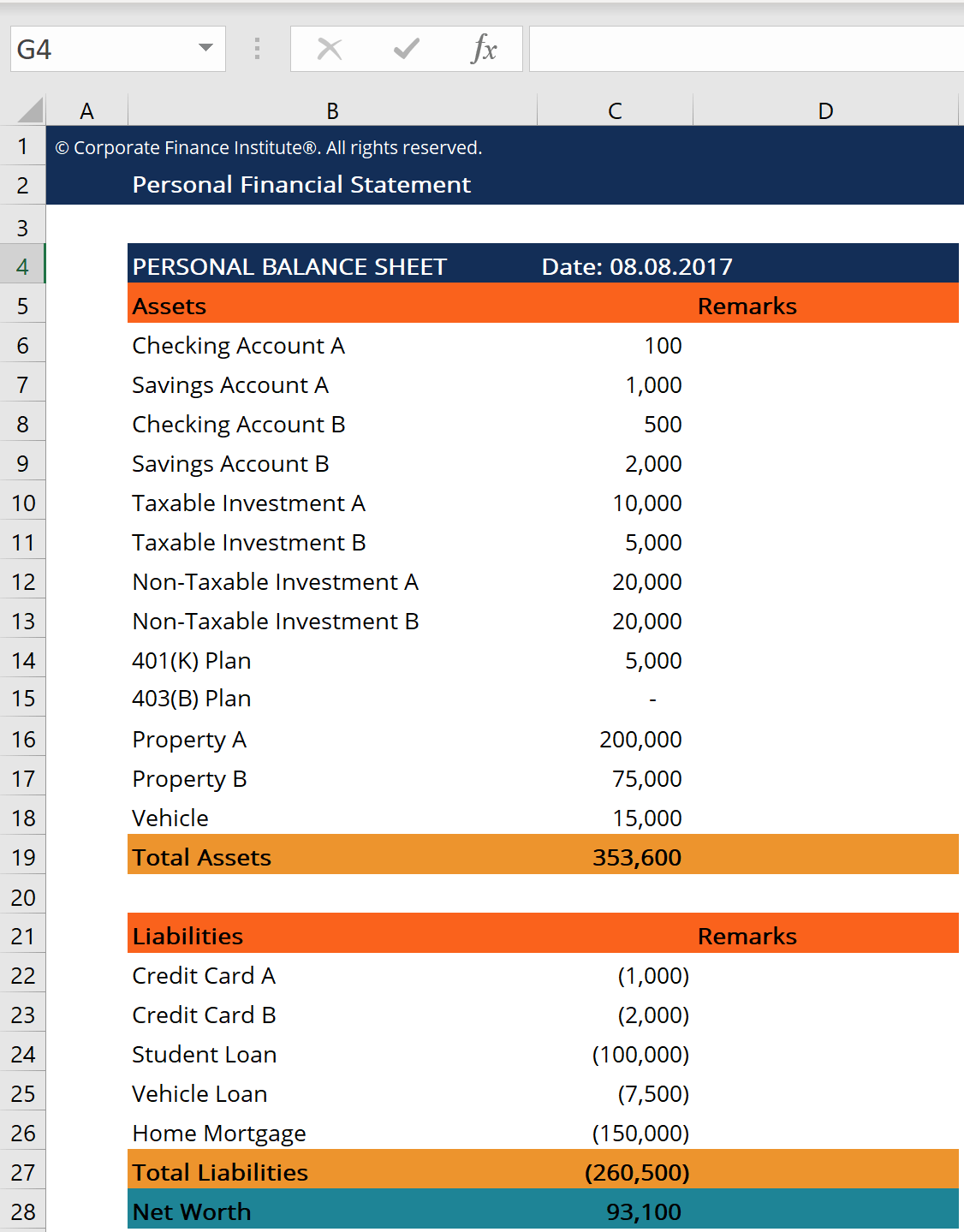

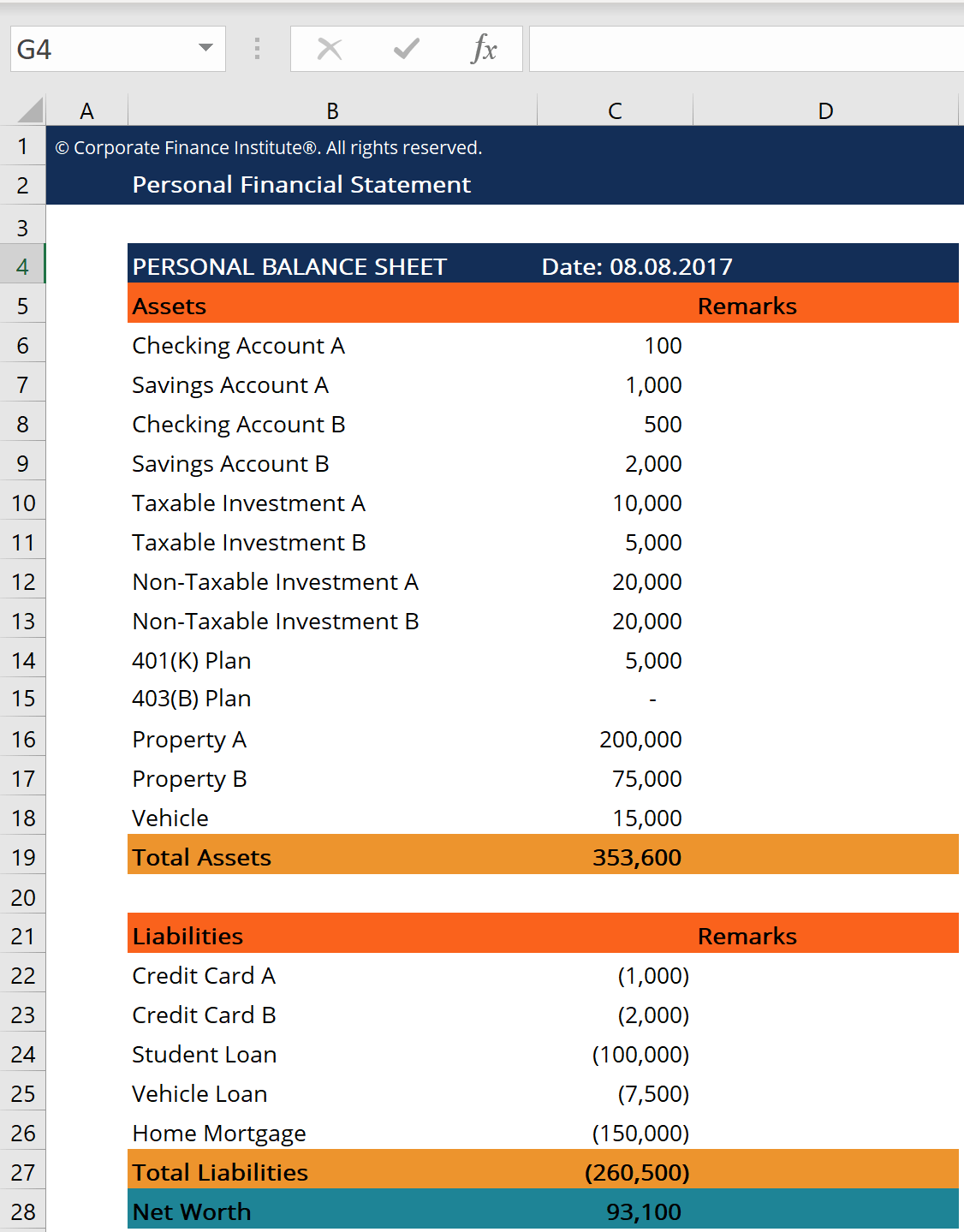

Net-worth calculation is purely a mechanical process- assets minus liabilities.

What should a personal financial statement include. As previously mentioned there are two core sections of any PFS. Some of the assets and liabilities that should be listed include. Most recent statements to substantiate the amount listed.

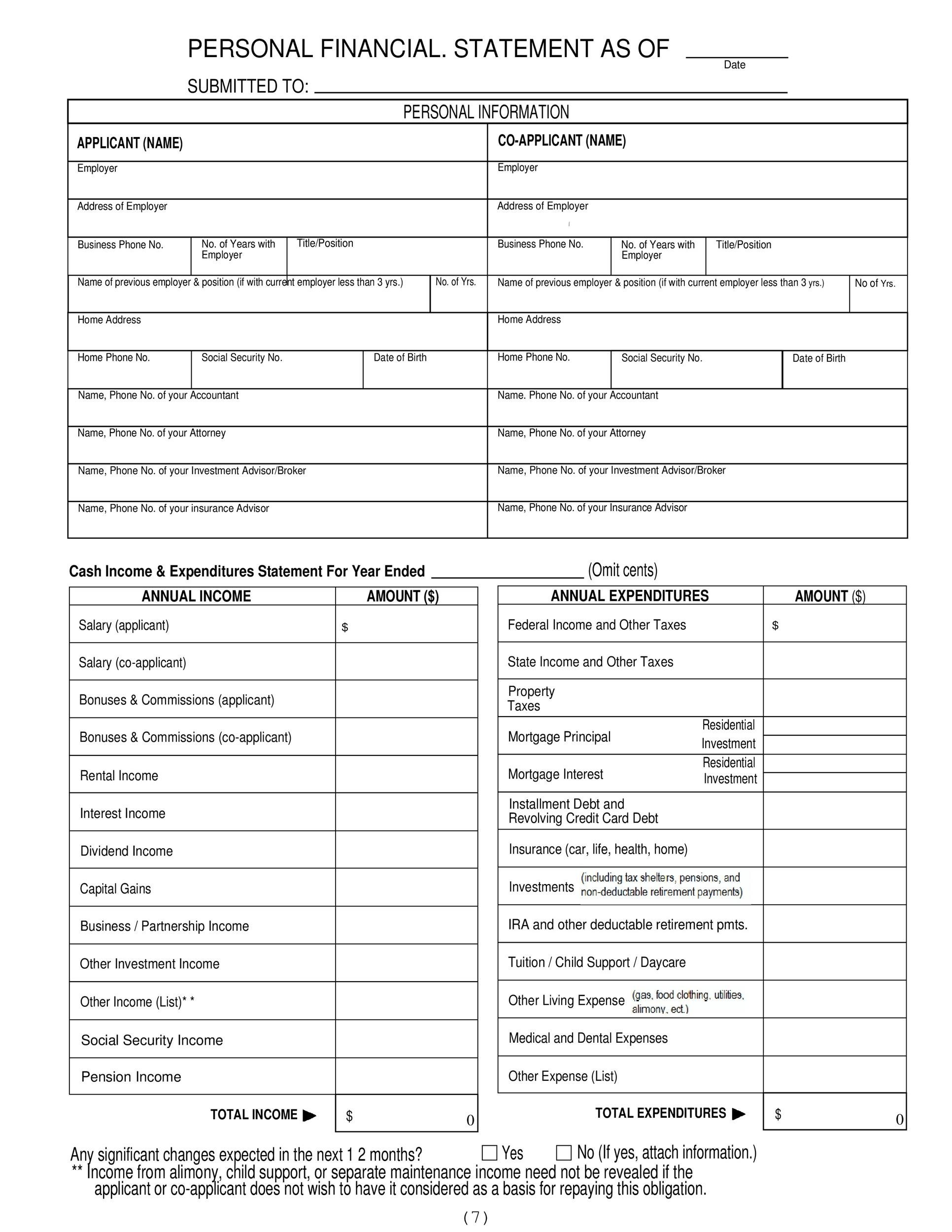

When evaluating the financial health of a company bankers and investors rely on three types of financial statements. Evaluate your personal financial statements to gauge your financial health. Detailed retirement account statements 401k IRA etc Life insurance statements that show current cash value.

It is basically an invitation for the reader to know about you and how you are a perfect fit for a particular field of study. What to Include in Your Personal Financial Statement. Ofcourse you should include it on your net worth calculation.

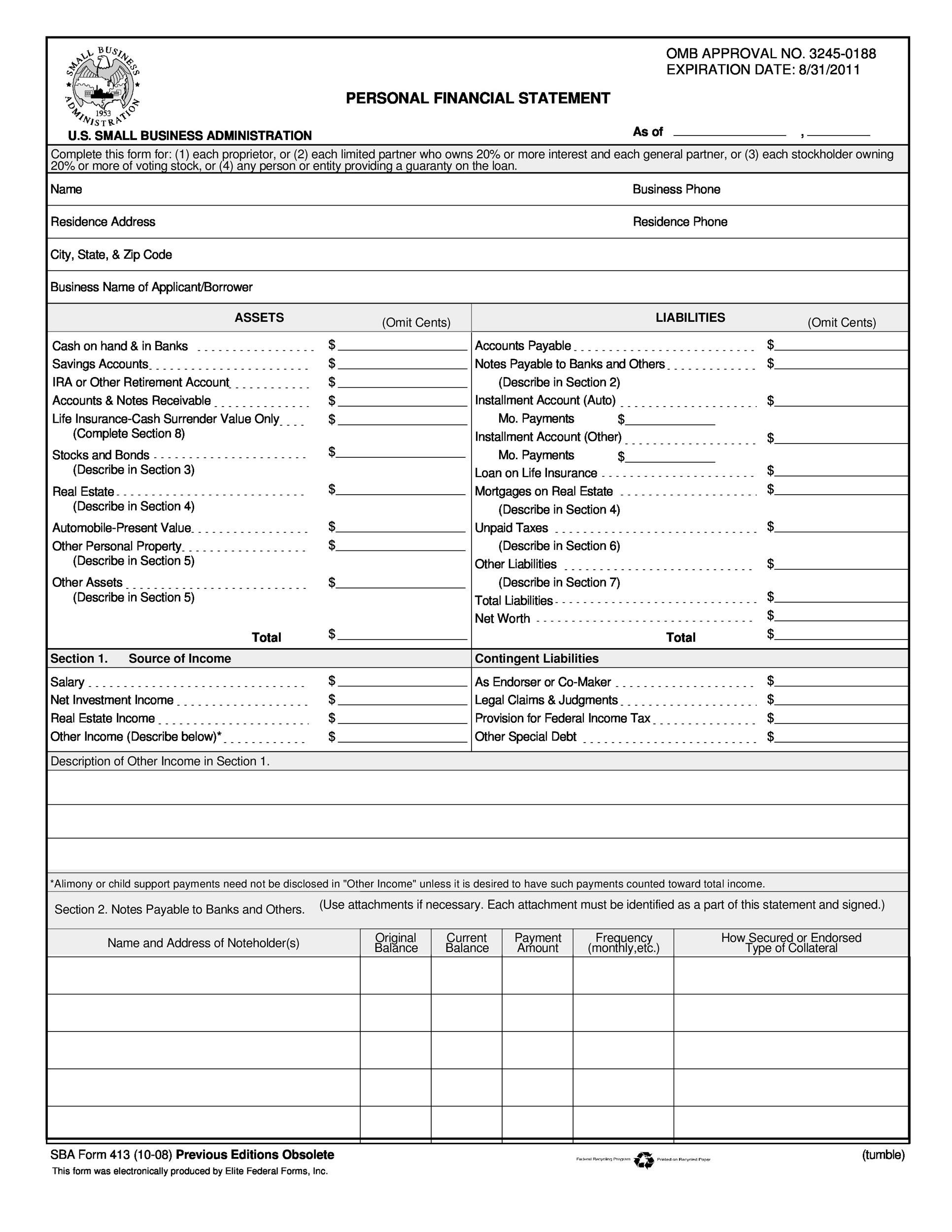

Pay stub with year to date pay or annual salary. To develop an estate retirement or other financial plan. As for other entities personal financial statements may be preparedin conformity with a comprehensive basis of accounting other than GAAP.

It lists your assets what you own your liabilities what you owe and your net worth. Think of your Balance Sheet reports as a set of before-and-after photos with your Profit Loss report telling the story of what happened in between. September 04 2010.

For purposes of personal financial statements OCBOA includes forexample the tax return historical cost and cash receipts anddisbursements bases. Moreover it should give an idea about your priorities and judgment and lastly your story. Cash in a checking or savings account An IRA 401 k or any other retirement accounts Brokerage accounts A copy of the latest statement on your home mortgage with the balance outstanding you may also need a recent.

Net worth can fluctuate over time as the values of asset and liabilities. To get your net worth subtract liabilities from assets. For various investment transactions.

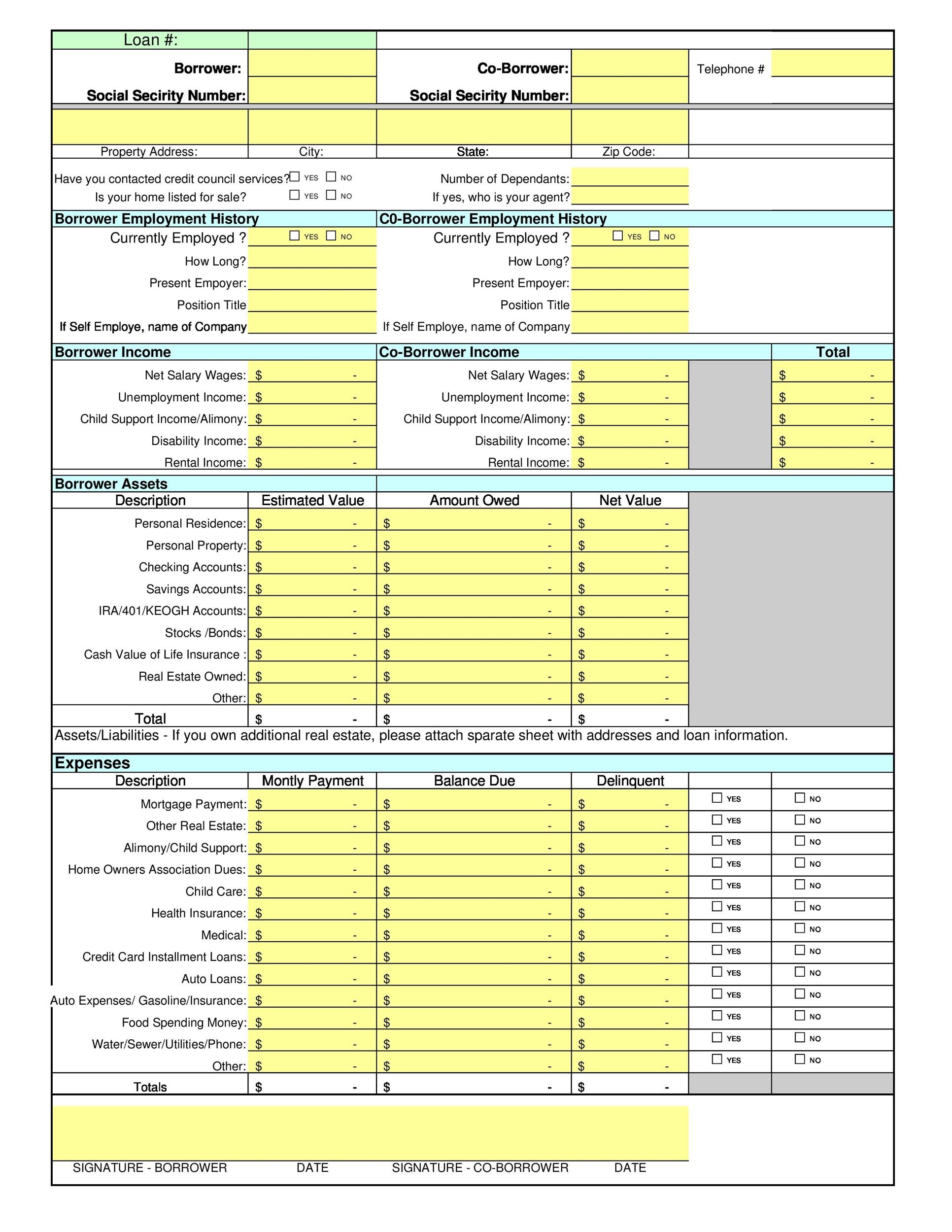

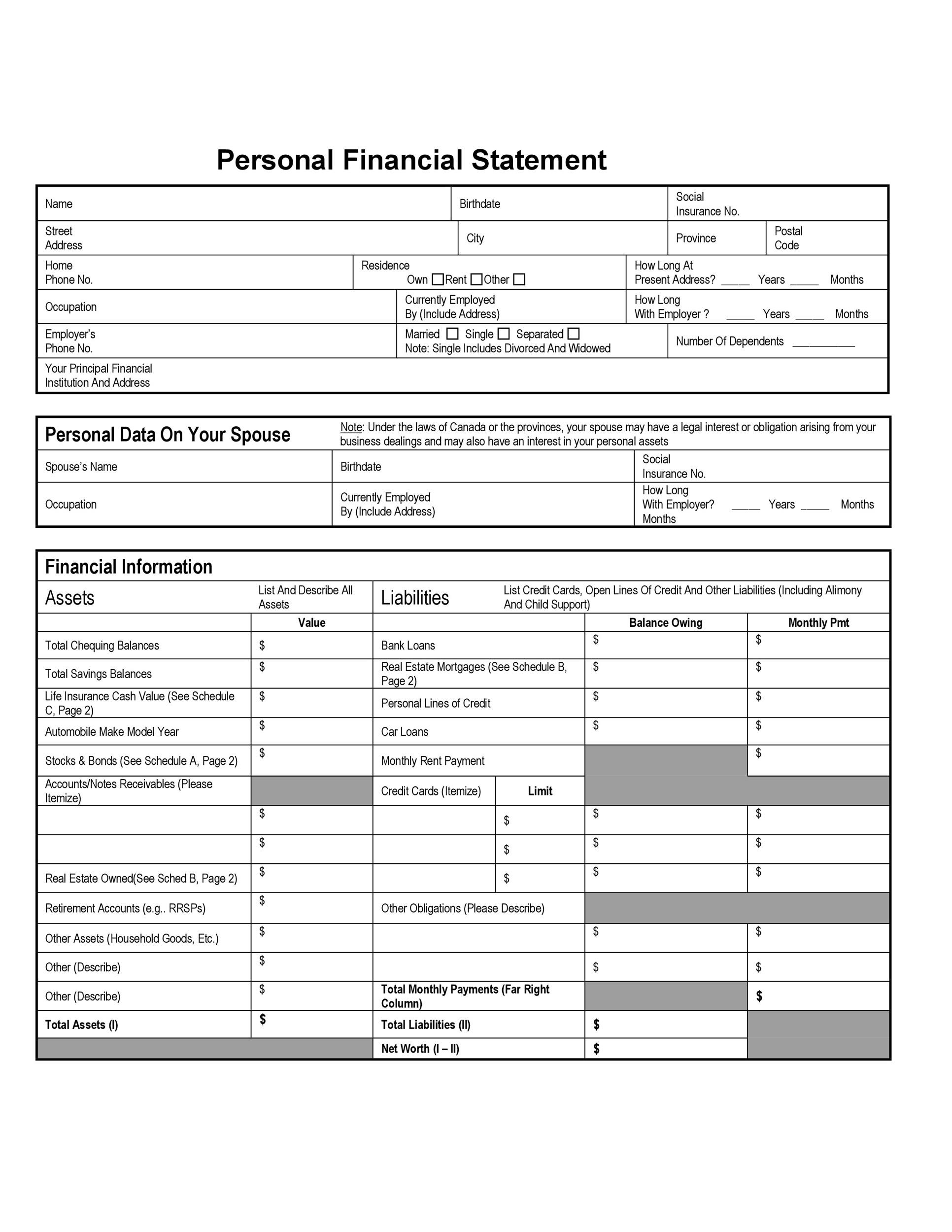

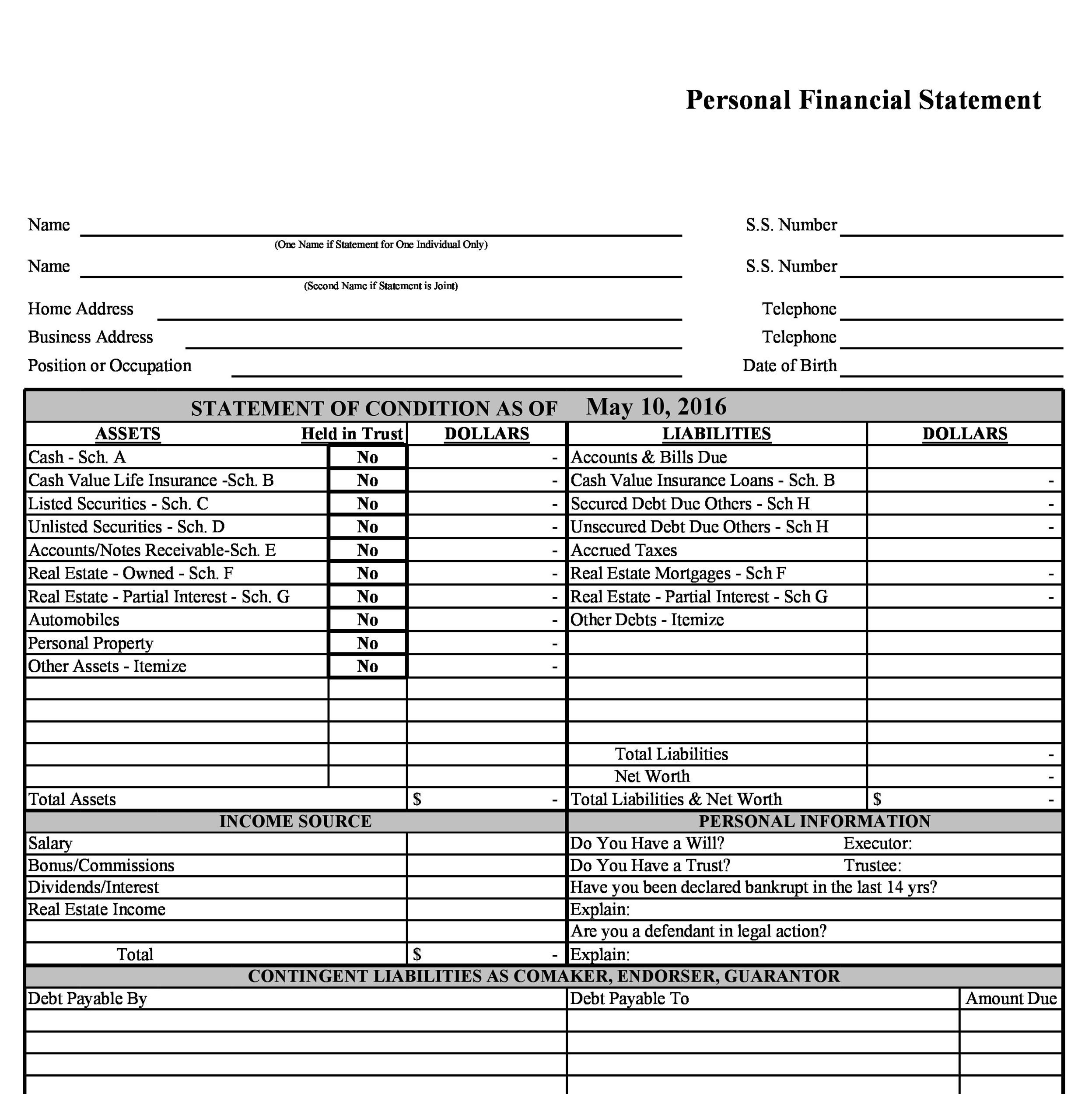

A startup costs worksheet. A startup budget or cash flow statement. It is usually composed of two sections a balance sheet section and an income flow section.

Get organized before beginning your application by gathering the following financial documents. Detailed bank statements for checking and savings accounts. You may need several different types of statements depending on the requirements of your lender and your own technical expertise.

A complete description is required in Section 3. Generally it includes a picture of you as in a written portrait. A personal financial statement is a document or set of documents that outlines an individuals financial position at a given point in time.

An individuals net worth is determined by subtracting their liabilities from their assetsa positive net worth shows. Accounts Notes Receivable. As a normal part of applying for a business loan your bank will ask you to complete a personal financial statement.

Generally a personal financial statement should be prepared using the estimated current values of all assets. Every student must know things to include in a personal statement. A copy of the.

You may require a personal financial statement in any of the following circumstances. This may include your home mortgage car auto loan taxes savings accounts investment accounts credit card balances and more. Key Takeaways A personal financial statement lists all assets and liabilities of an individual or couple.

To make a guarantee. Enter the total value of all monies owed to you personally if any. Provides a snapshot of the value of.

529 is certainly NOT your childs asset. If you exclude certain things like the value of your home from your assets call the calculation something else like My liquid assets minus liabilities. This should include shareholder loans to the applicant firm.

The statements you will certainly need are. A personal financial statement is a snapshot of your personal financial position at a specific point in time. A personal financial statement is a document outlining an individuals financial position at a point in time based on their assets and liabilities.

Heres how each section can be defined. Liabilities should be listed at the estimated amount of cash to be paid. Ideally personal financial statements are used to show your personal assets net worth income and expenses.

Your balance sheet will include all your assets and liabilities. If a loan can be paid at an amount less than face value then that lesser amount is what should be listed on the personal financial statement. Enter only the cash surrender value of any life insurance policies.

To obtain a loan. With a bit of practice understanding financial statements is easy. An income statement which incorporates income and expenses for a period of time A balance sheet which shows net worth at a point in time.

Personal Financial Statement For Excel

Personal Financial Statement For Excel

Personal Financial Statement Know Your Financial Position Now

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Personal Financial Statement Know Your Financial Position Now

0 Response to "20+ What Should A Personal Financial Statement Include"

Post a Comment